- Home

- Business

Business & Economy

Corruption in Sports: A Close Examination of Nasra Abukar’s Case and African Footballers' Struggles

Young Entrepreneurs Reshape Nigeria's Booming Real Estate Market

The boom being experienced by the real estate market in the country has caught the entrepreneurial instinct of a new generation of developers who aim to bridge the country’s huge housing deficit an...

South Africa reeling as lights go out in ongoing loadshedding blackout saga

The sign outside a small but popular coffee bar in central Cape Town reads: ‘Opening Hours — Ask Eskom’. Not that asking the state-operated electricity provider would be of much us...

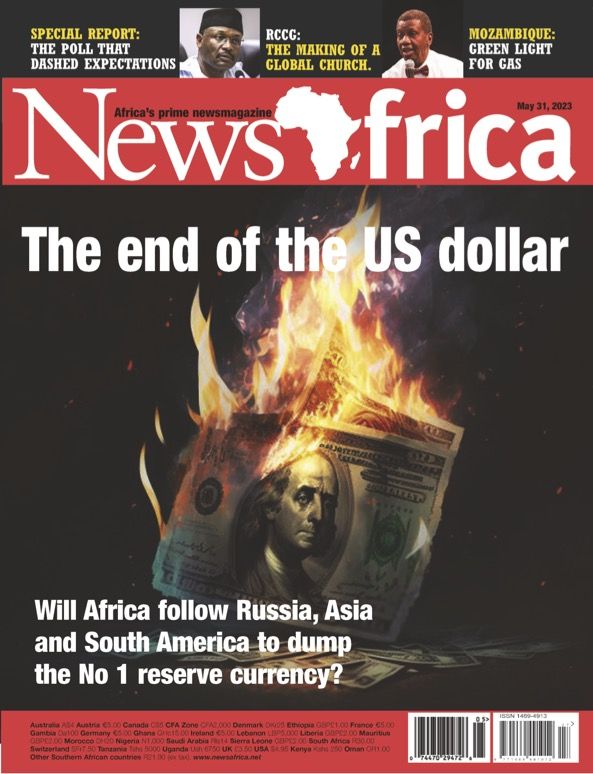

Is it time for Africa to ditch the US dollar in trade deals?

When American senator Marco Rubio spoke on Fox News in early April about the invisible ‘conflict’ between China and the West, he accidentally gave a very good reason why countri...

Latest Business

Mozambique's liquefied natural gas (LNG) site to reopen following 2021 terror attacks

| Tomas Queface

The French oil and gas company TotalEnergies looks set to resume its liquefied natural gas (LNG) extraction project in Mozambique’s troubled Cabo Delgado province, two years after it suspended activities due to a terror attack at its facilities.

Work on the Mozambique LNG proje...

Nigerian insurance sector grows by 22 per cent

| NewsAfrica

Newly released figures show Nigeria’s comatose insurance sector may finally be waking up. By Martins Azuwike in Lagos.

Leaders to meet for African energy summit

| NewsAfrica

World leaders and energy giants to discuss ways to harness Africa’s 'green energy’ potential at the NAFNIS 2022 event.

The end of the petrodollar could be good for Africa

| NewsAfrica

As Russia demands Europe pay for gas in roubles, Sizwe Lo looks at the US dollar’s prominence in global trade – and the impact of its demise for Africa.

Anger as Botswana govt plans luxury hotels inside Chobe National Park

| NewsAfrica

Tourism body slams Botswana government over decision to build eight luxury lodges in wilderness area. By Oarabile Mosikare in Gaborone.

African business news round-up: April 2022

| NewsAfrica

A look at why the Central African Republic is embracing cryptocurrencies, Ethiopia is embracing M-Pesa, and Sasol is hoping to capitalise on the EU-Russia fallout.

Ghana introduces austerity following lockdown losses

| NewsAfrica

As lockdown spending sees Ghana’s national debt balloon, the government is forced to make cuts to survive. By Cliff Ekuful in Accra.