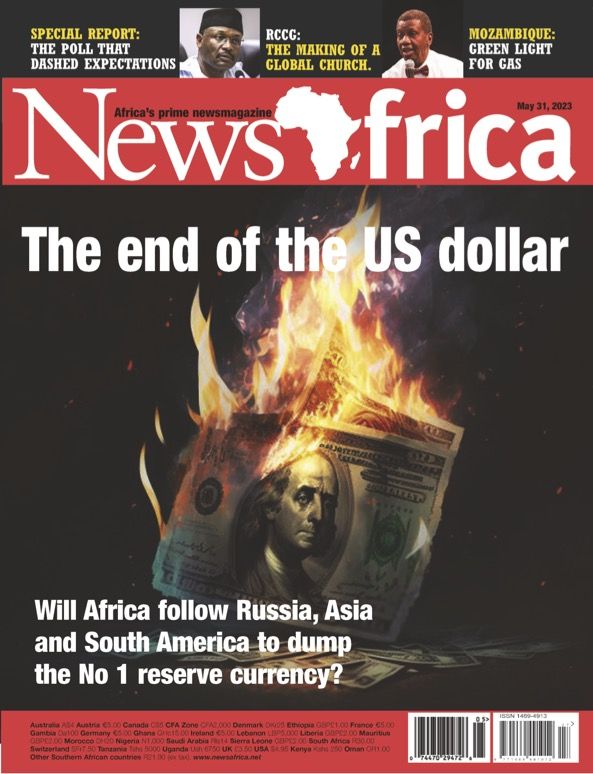

As Russia demands Europe pay for gas in roubles, Sizwe Lo looks at the US dollar’s prominence in global trade – and the impact of its demise for Africa.

In July 1944, delegates from 44 US-allied countries met in Bretton Woods, USA, where they formed the International Monetary Fund (IMF) and World Bank.

However, the founding of these two institutions was not the most significant event to come from the conference.

The most important was the Bretton Woods agreement, which said the United States dollar (USD) would be fixed to the price of gold at $35.

If anyone had $35 and got tired of holding paper money, they could exchange it for an ounce of gold, guaranteed.

This agreement meant that all other national currencies would be held at a fixed exchange rate with the dollar instead of gold.

If a country wanted to buy anything from the international markets, or even from each other, it would need to get US dollars first.

This arrangement was agreed to for various reasons.

Firstly, the conference took place towards the end of the Second World War.

The nations in attendance were devastated by the conflict, and the Americans were willing to help them rebuild if they cooperated.

Secondly, the agreement to fix the dollar to gold was done on the understanding the United States Federal Reserve (the Fed) would not print dollars recklessly since gold is very rare.

Still, the biggest winner was America, because this deal meant that there was to be a huge and automatic global demand for the dollar as it was now the 'preferred’ – ie only – international medium of exchange.

On shaky ground

By 1971, the America’s trade deficit and debt had increased to unsustainable levels, domestic spending was out of control.

The US had spent $200 billion on the Vietnam war and was losing.

This and other debt incurred through poor fiscal and monetary discipline meant the US's overconsumption was becoming a problem.

Because the dollar was exchangeable for gold, many nations started asking for their gold stored in the US and giving America her paper money back. However, the US was running out of gold.

Giving out gold in exchange for pieces of paper was not sustainable.

America was in trouble, and the Bretton Woods agreement needed redefining.

Realising the US would not be able to meet its obligations, President Richard Nixon's administration chose to unilaterally remove the USD's convertibility into gold in August 1971.

Now the US Federal Reserve could print dollars at will without worrying about not having enough gold to exchange for this newly printed paper money.

It came at a cost to the US: oil prices soared, inflation rose to above 15 per cent, GDP fell 3.2 per cent and unemployment reached nine per cent.

Above: A well in Angola, one of Africa's major oil-producing regions.

Enter the petrodollar

As the turmoil ripped through the American economy, the government-imposed wage and price controls which caused severe fuel shortages around the country.

But in 1973, the Americans held secret discussions with the Saudi Royal Family.

They struck a deal to exchange America’s military prowess for Saudi Arabia’s promise to sell its oil exclusively in US dollars and reinvest the money in the US by buying Treasury bonds. In return, America would ensure that the Saudi Royal Family remained in power.

So, from then on, any country that wanted to purchase oil from OPEC, which was dominated by Saudi Arabia, was forced to use US dollars.

This became known as the petrodollar system. Any country that wanted to buy oil from Nigeria, Libya or Algeria, for example, had to first convert its currency to US dollars. Demand for the dollar skyrocketed.

While other countries around the world had to export goods and services to earn the dollars needed to buy oil, the US simply had to print the dollars it needed to buy oil.

However, it wasn’t just the government that borrowed heavily. By 2010, American consumers and corporations had racked up trillions of dollars in debt adding up to a total of $140 trillion in debt.

It's not difficult to see why it is in America’s interest to maintain the petrodollar.

It further explains why the US might be willing to go to war with anyone who challenges the petrodollar. Some of those who have been destroyed for attempting to trade in other currencies include the former Iraqi president Saddam Hussein and the Libyan leader Muammar Gaddafi. Gaddafi publicly proposed that he would sell oil in a Pan-African currency to all African nations. He was subsequently killed in an American-backed 'revolution'.

Before this, Hussein had tried to sell oil in euros. His country was similarly invaded, and Hussein too was killed.

As American filmmaker Addison Wiggin put it: 'The petrodollar system breaking down, where oil is no longer paid for in dollars internationally, essentially would be the death knell to the US dollar as the reserve currency.

It means the US can't borrow with 'exorbitant privilege' anymore, and it means the US Treasury market is set for an out-of-control interest rate spiral.'

If countries were to start trading oil using any other medium than the US dollar, like gold or the Nigerian naira, for example, America's economic dominance would likely come to an abrupt end.

On March 23, 2022, Russian President Vladimir Putin announced that some ‘hostile’ countries would have to pay for Russian gas in roubles. This decision immediately strengthened the Russian currency against the euro and dollar.

According to the Russian newspaper Izvestia, economists are confident that is the only way to overcome the dominant role of the US dollar.

Furthermore, the Bank of Russia announced that from March 28, the rouble would be fixed at 5,000 roubles for a gram of gold.

Again, just like oil, gold is denominated and sold in dollars on the international market, so this was another break with tradition by Putin. Russia has further signalled an intention to apply these policies to all the commodities it exports: oil, wheat, nickel, aluminium, enriched uranium and neon.

Meanwhile, Saudi Arabia has indicated that it may be willing to start accepting the Chinese yuan in exchange for oil.

Other countries including Iran, Venezuela, Syria and North Korea are also considering moving away from dollar-based oil and gas transactions.

For years now, China has been developing an alternative to the SWIFT payment system, which would allow for international transfers between banks, bypassing the US and the dollar.

The recent sanctions blocking Russian banks from SWIFT have further galvanised the development of alternatives to the payment system and, by extension, the dollar.

What the future holds for the petrodollar and the leveraging of the dollar’s reserve currency status in pursuit of US geopolitical objectives remains to be seen, but one thing is clear if the petrodollar comes to an end, so will the United States as a world superpower.

Africa and the petrodollar

Even after extensive investments and extraction by foreign actors, the resource industries have not brought wealth to Africa.

This is largely a result of neoliberal reforms, economic sanctions, financial support, and of course, the petrodollar monetary order.

An illustration of this is what happened after the dollar was removed from the gold standard in 1971.

In Africa, the oil crisis that followed ended development, industrial and agriculture improvement, and any hope of a better life during the 1960s post-colonial period.

Furthermore, the oil crisis, combined with severe drought, led to harvest shortfalls.

African countries faced not only famine, but the distress brought on by the oil shock. Their economies were decimated as a result of the quadrupling of primary oil prices.

Africa’s economy was damaged the most compared to other regions due to the American petrodollar recycling strategy and the dependence on exporting a few primary raw materials to earn enough USD to buy oil.

The prices of these raw materials were falling steadily, and in 1987 reached the lowest levels since the Second World War.

Africa's debt to Western creditors doubled between 1982 and 1990 through 'debt restructuring’ and various other IMF economic interventions.

Many economists argue that these countries would not have been in debt without the petrodollar recycling strategy, given that the price of raw materials had remained low and relatively stable throughout the decade.

To this day, the petrodollar recycling strategy is still in use: Western banks give loans to African countries and these dollar-denominated loans make up a large part of national revenues that are in turn taken up by Western imports at inflated prices. These monies are then channelled into the Western banks and then accumulated into loans re-released to the developing countries.

This is classic petrodollar recycling, a debt trap that Africa can never hope to escape while the petrodollar system is still in use.

However, not every economist agrees that ditching the dollar as Putin has done, will solve the issue of African indebtedness.

'The strength of a currency is driven largely by the size of its economy, its export capacity and the degree of integration into the global economy,’ explained Muda Yusuf, Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE).

He said that African countries need ‘all the foreign capital they can get to strengthen their balance of payment position’, adding: ‘They need the global economy more than the global economy needs them. Contemplating a policy of demanding for local currency payments for their exports would only be academic.’