Is it time for Africa to ditch the US dollar in trade deals?

As everyone from Brazil and Argentina to Algeria and Sudan ditch the US dollar in international trade deals, Jasmine Birtles asks what the future holds for Africa as the American empire loses its grip on the world’s purse strings.

When American senator Marco Rubio spoke on Fox News in early April about the invisible ‘conflict’ between China and the West, he accidentally gave a very good reason why countries like China, Russia, India, Nigeria and Algeria are currently dropping the US dollar for trade and other transactions.

He said: ‘Brazil, the largest country in the Western Hemisphere, cut a trade deal with China. They’re going to, from now on, do trade in their own currencies.

‘They’re creating a secondary economy in the world totally independent of the United States.

'We won’t have to talk about sanctions in five years, because there’ll be so many countries transacting in currencies other than the dollar that we won’t have the ability to sanction them.’

The dollar’s privileged position as the world’s reserve currency has given the US a disproportionate amount of influence over other economies.

In fact, the US has for a long time used the imposition of sanctions as a tool to achieve foreign policy goals.

And, as far as most countries in Africa, Asia, South America and the Middle East are concerned, the dollar’s hegemony – established in 1944 – is coming to an end. And fast.

In fact the dollar’s share of global foreign-exchange reserves has already fallen sharply. It fell below 59 per cent in the final quarter of last year, according to the International Monetary Fund’s (IMF) Currency Composition of Official Foreign Exchange Reserves data.

The research also noted that countries had not taken on British sterling, the euro or Japanese yen instead, but that a quarter of transactions had moved to the Chinese renminbi – more commonly referred to as the yuan – and three quarters into the currencies of smaller countries that had had some limited role in the past as reserve currencies.

- Sanctions against Russia a massive own goal

In 2014 the BRICS countries (Brazil, Russia, India, China, South Africa) started to formulate a plan to detach themselves from the US dollar, hinting at a currency that could be used between the organisation’s countries after sanctions were imposed on Russia when it invaded the Crimea.

Imposing even stricter sanctions on Russia when it invaded Ukraine in 2021 backfired on the US as it pushed Moscow even further into the arms of Beijing, while simultaneously spooking many other countries around the globe.

If such a big, world player as Russia could be sanctioned, they reasoned, what will they do to us if we don’t play ball?

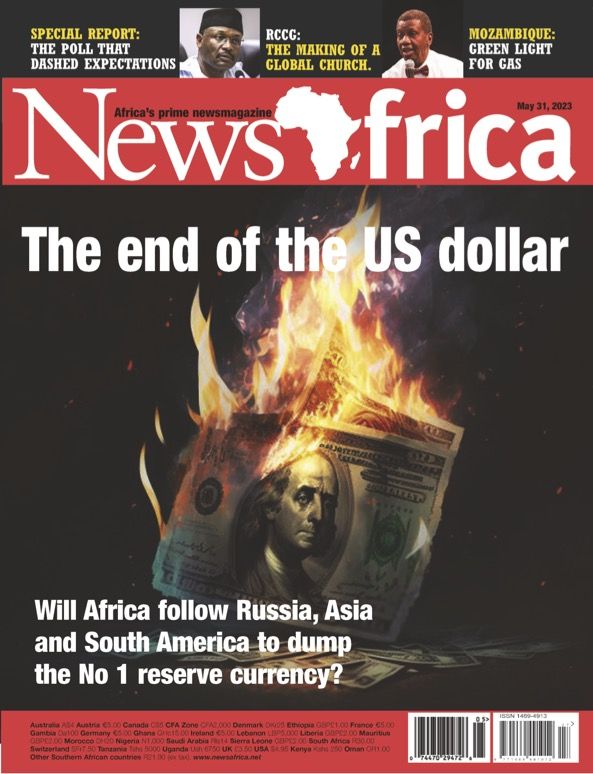

In March this year, President Vladimir Putin of Russia declared that around two-thirds of the trade between Russia and China already used the yuan and Russian rouble and that he was in favour of using the yuan when trading with Asian, African and Latin American countries.

As mentioned above, China and Brazil signed a landmark deal between themselves to use the yuan for mutual trade.

Right now several countries, and groups of nations, are working out ways of avoiding use of the US dollar in trade.

Although the BRICS countries are primarily concerned about the political ramifications of the US dollar, many countries are also looking into alternatives because the soaring value of the US dollar has crippled their economies and contributed to their rising cost of living.

For example, the Indian rupee has fallen by nearly 10 per cent this year against the dollar, the Egyptian pound 20 per cent and the lira in Turkey (where prices have more than doubled) has dropped by 28 per cent.

As professor Glenn Diesen of South Eastern Norway university said: ‘Weaponising an inflated currency, burdened with unsustainable debt, will be the end of the dollar.’

And so it is proving – in Asia, across Africa, South America and the Middle East; and it is happening fast.

Above: Currency rebels Xi Jinping of China and Russia's Vladimir Putin.

- A golden opportunity for African nations

The US dollar’s diminishing role in international trade has emboldened African nations to make moves towards unshackling themselves from American influence by strengthening their own national currencies or working on new currencies that would be used for trading within the continent.

For example, the East African Community (EAC) is working on a regional currency called the East African Shilling.

The Southern African Development Community (SADC) is also looking into creating a common currency.

Africa's new intra-continental trade block, the AfCFTA, has called on members to trade in local African currencies. Speaking in late-March, an official from the AfCFTA said the bloc is working on a pan-African payment and settlement system to enable local currencies to be used in trade between countries across the continent.

Cross-border trading between countries in the Economic Community of West African States (Ecowas) is already happening through the use of local currencies, according to Wamkele Mene, Secretary General of the AfCFTA Secretariat.

He said: 'We now want to expand to other regional blocs including the East African Community which is in talks with the African Export-Import Bank.'

He added that the cost of currency convertibility with US dollars in trade among African countries is close to an eye-watering $5 billion a year, another good reason for them to ditch the dollar.

The six-nation Economic and Monetary Community of Central Africa (CEMAC) is also considering joining West Africa in creating a shared currency.

- Individual countries doing their own deals

Recently, Sudan has announced that it wants to expand ties with Russia and the central banks of the two nations are discussing ways that they can switch to national currencies in mutual settlements.

Sudan’s ties with Russia have been growing in recent years.

Sudan had relied militarily on Russia under President Omar al-Bashir, until international isolation and crippling US sanctions effectively ousted him in 2019.

In December 2020, Russia announced a 25-year deal with Sudan to build and operate a new naval base for the country at Port Sudan.

Sudan was one of the countries that abstained from a UN General Assembly vote condemning Russia’s invasion of Ukraine.

Potentially, Sudan could provide Russia with cotton, food supplements and fruit while Moscow could sell Sudan much needed grain and oil.

Africans want to trade in their own currency rather than US dollars.

In response to these growing connections, the US is working hard to regain control over the country and restrict Russia’s influence.

Algeria, Africa’s largest exporter of natural gas – a vital supplier to Europe since sanctions against Russia – officially applied in November 2022 to join the BRICS group which, among other things, would enable it to join in with the BRICS currency.

Its fellow Arab League members Saudi Arabia and Egypt have also expressed interest in joining BRICS.

Algeria’s windfall profits from energy exports were above $50 billion last year, but Washington is now demanding that it cuts economic ties with Russia regardless of its own sovereign interests.

In Kenya, President William Ruto signed an agreement in March with three international oil companies to allow them to buy oil using the Kenya shilling rather than US dollars.

This was after a rising dollar shortage in the country.

The president announced that it had saved the country $500m (KSh 66.8bn) every month in buying the fuel in this way.

Iran has suggested a joint bank with African states to help promote trade between them. The idea being that they could trade without resorting to dollars or euros.

Trade between Iran and Africa stood at nearly $1 billion between March and October 2022. Iran exported just over $933 million worth of goods during the nine-month period.

Also, the Reserve Bank of India (RBI) has invited the central banks of 18 countries, including Tanzania, Kenya, and Uganda, to open Vostro Rupee Accounts (SVRAs), in order to transact with them in Indian rupees instead of US dollars.

In February, top economist Nouriel Roubini said that the Indian rupee could ultimately become one of the global reserve currencies of the world.

President William Ruto of Kenya has announced plans to deal in currencies besides the US dollars.

- Dollar contagion in the West

It’s not just the US dollar that is finding itself out in the cold in African nations either.

The CEMAC bloc, whose members include Gabon, Cameroon, the Central African Republic, Chad, the Republic of the Congo and Equatorial Guinea, has announced that it will stop using the Franc CFA (FCFA), opting for a complete change of name.

It was considered necessary because of the recent euro/dollar crisis which affected the Franc CFA.

The fixed rate of exchange between the CFA franc and the euro dictates the monetary and exchange rate policies of the CFA-zone nations and, it’s argued, holds back these countries.

CEMAC is also reportedly considering joining West Africa in creating a regional currency called the ECO.

- Other countries around the world dropping the dollar

Although many African countries are well on the way to ditching the dollar, they have some catching up to do with other nations that are further down that road.

The Brazilian government announced mid-April that it had agreed to trade directly with China in their own national currencies, avoiding using the dollar as an intermediary.

This will enable Brazil, the largest economy in South America, and the economic behemoth that is China, to transact and trade directly with yuans and reals, keeping the US out in the cold.

In March, finance ministers and central bank governors from the Association of Southeast Asian Nations (ASEAN) discussed dropping, not just the US Dollar, but also the euro, the yen, and sterling in financial transactions, instead using local currencies for trade.

ASEAN includes Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

The bloc’s combined nominal GDP is around $3.9 trillion, according to the IMF.

Leaders of Asia's ASEAN bloc are growing closer with Russia's President Putin.

Naturally, Russia has been moving away from dollars and euros in the last year after Western sanctions.

Cleverly, the nation is in talks with various other countries to negotiate trade using national currencies rather than dollars or euros.

So far, Russia is not insisting that ‘friendly’ countries use roubles, rather encouraging each nation to develop the strength of their own currencies.

Saudi Arabia has announced that it is open to discussions about trade in currencies other than the US dollar, according to the kingdom’s finance minister.

This is a particularly significant move as it effectively heralds the end of a decades-long, uneasy coalition between the US and the Middle-Eastern nation.

Even France could be moving away from the dollar.

After a six-hour meeting with Chinese leader Xi Jinping in April, President Emmanuel Macron stated that Europe needs to reduce its dependence on what he called the 'extraterritoriality of the US dollar' – something that both Moscow and Beijing have been promoting for a few years.

- An opportunity for gold

It’s no coincidence that gold keeps coming up in international debates over currencies and the creation of new ways to trade.

Russia, China and India have huge reserves of gold which they are increasing.

Middle Eastern countries too are heavily invested in gold.

As fiat currencies such as the dollar, euro, yen and British pound lose trust because of the rampant money-printing Western governments embarked on to fund lockdowns, gold looks more solid and dependable to many.

Cameron Parry, CEO of the gold-backed savings app Tallymoney told NewsAfrica: ‘Dealing with a country with large gold reserves does give some perceived comfort as having gold demonstrates the country has some saved up wealth in the form of a precious asset, but the increasing stockpiling of gold by many countries, to my mind reflects more that when the fiat currency system is reset, gold will be used as the universally accepted and understood anchor of value.’

He added: ‘Governments will back their currency fractionally – eg 40 per cent of the dollars will be backed by gold held by the US Federal Reserve, such as it was prior to 1971.’

Tim Price, of London fund managers Price Value Partners, believes that gold, and other money metals, are just at the start of a bull run, thanks to the weakness of so many fiat currencies.

He told NewsAfrica: ‘I think it’s tremendously positive for gold and silver (as they’ve historically always been money) and positive for real assets generally, including energy and commodities, where there has been secular underinvestment in core infrastructure for decades.

‘Gold has already appreciated by over 500 per cent in US dollar terms over the last 20 years but as the trend towards de-dollarisation accelerates, I suspect the best is yet to come.’

This is certainly beginning to show in African, Asian and South American nations.

Ghana's cedi is in serious trouble. Could ditching the dollar help?

In November 2022, Ghana's finance minister said the country was at high risk of debt distress as its currency, the cedi, had depreciated against the US dollar, increasing its foreign debt by $6 billion this year alone.

But, the vice-president, Mahamudu Bawumia, announced on Facebook that Ghana was working on a new policy, effective next year, to buy oil with gold rather than US dollars as part of government measures to strengthen the cedi.

Gideon Boako, the spokesperson of the vice president in a text to VOA said: 'It is basically going to be [a] government-to-government transaction. The significant drain on the forex is from oil imports. Once you lock that tunnel, you are good on the FX side.'

He added: 'The government of Ghana will buy gold locally with cedis through the Bank of Ghana and then exchange the gold for fuel (oil) in a barter form, for example, with the government of UAE.'

- Could Bitcoin become a reserve currency?

Bitcoin, and other cryptocurrencies (notably ‘stablecoins’) have steadily been increasing in value and relevance as fiat currencies lose their foothold.

There are still far too many obstacles in their way for any one cryptocurrency to become the global currency any time soon but in many countries, particularly African and South American nations, cryptocurrencies are providing genuine competitor to both the dollar and local currencies.

In Africa, for example, 1.4m consumers use Yellow Card which offers an experience similar to Block’s Cash App. It’s the largest centralised cryptocurrency exchange in Africa and is a lifeline for many who don’t have access to other acceptable currencies with which to trade.

Yellow Card customers can receive cryptocurrency from anywhere in the world and pay only a network fee of between five cents and $1, which makes it a credible competitor to Western Union or MoneyGram. It’s a huge help to many Africans, who rely on money sent home from abroad.

The latest data from the World Bank shows that in sub-Saharan Africa, up to 65 per cent of adults have no formal bank access.

Meanwhile, it is more expensive to send money to countries in this region than to any other part of the world. On average, it costs $15.60 (7.8 per cent) to send $200 to or from Africa using the traditional banking sector, and can be as high as $38 or 19 per cent in some countries.

As Senator Rubio noted, America is losing its hold on economies around the globe, but not to any one currency.

It looks like we are moving towards a multi-polar reserve currency situation where national currencies, new currencies and cryptocurrencies rise from the dollar’s burning embers.

The end of the petrodollar could be good for Africa

As Russia demands Europe pay for gas in roubles, Sizwe Lo looks at the US dollar’s prominence in global trade – and the impact of its demise for Africa.

In July 1944, delegates from 44 US-allied countries met in Bretton Woods, USA, where the...

Congolese react to East African Community (EAC) membership

Congolese traders welcome the move to join the East African Community (EAC), but could Kenya be the real winner from the bloc's expansion? By Issa Sikiti da Silva in Nairobi.

A group of Congolese cross-border traders gather together at ...

Post-Brexit Ecowas deal dead on arrival

A new twist in the proposed UK-Ecowas pact may have dashed any hope of a Brexit bonus for West Africa, reports Francis Ezem.

Britain may have left the European Union (EU) as planned at the start of the year, but the much-anticipated uptick in tra...

Ghana introduces austerity following lockdown losses

As lockdown spending sees Ghana’s national debt balloon, the government is forced to make cuts to survive. By Cliff Ekuful in Accra.

Ghana's Minister of Finance, Kenneth Ofori-Atta, outlined a cocktail of measures on March 24 to try to tur...